Tax Deductible? Christmas Parties and Gifts

By Travis Bacon

December 02, 2021

Christmas is just around the corner, and we are all counting the days down until we knock off work for Christmas. Often businesses take the opportunity to strengthen their connections with employees, customers and suppliers. Surely you can claim a tax deduction for a bit of Christmas cheer? Well, no, it's not that simple. If we are being honest, it is a bit of a minefield, and many factors come into play. So let's take a bit of a closer look.

For the purpose of this article, a client also means customers, suppliers, contractors, etc.

Christmas Gifts

Firstly is it really a gift?

Just because your gifting something to someone doesn't mean it is a gift. What?

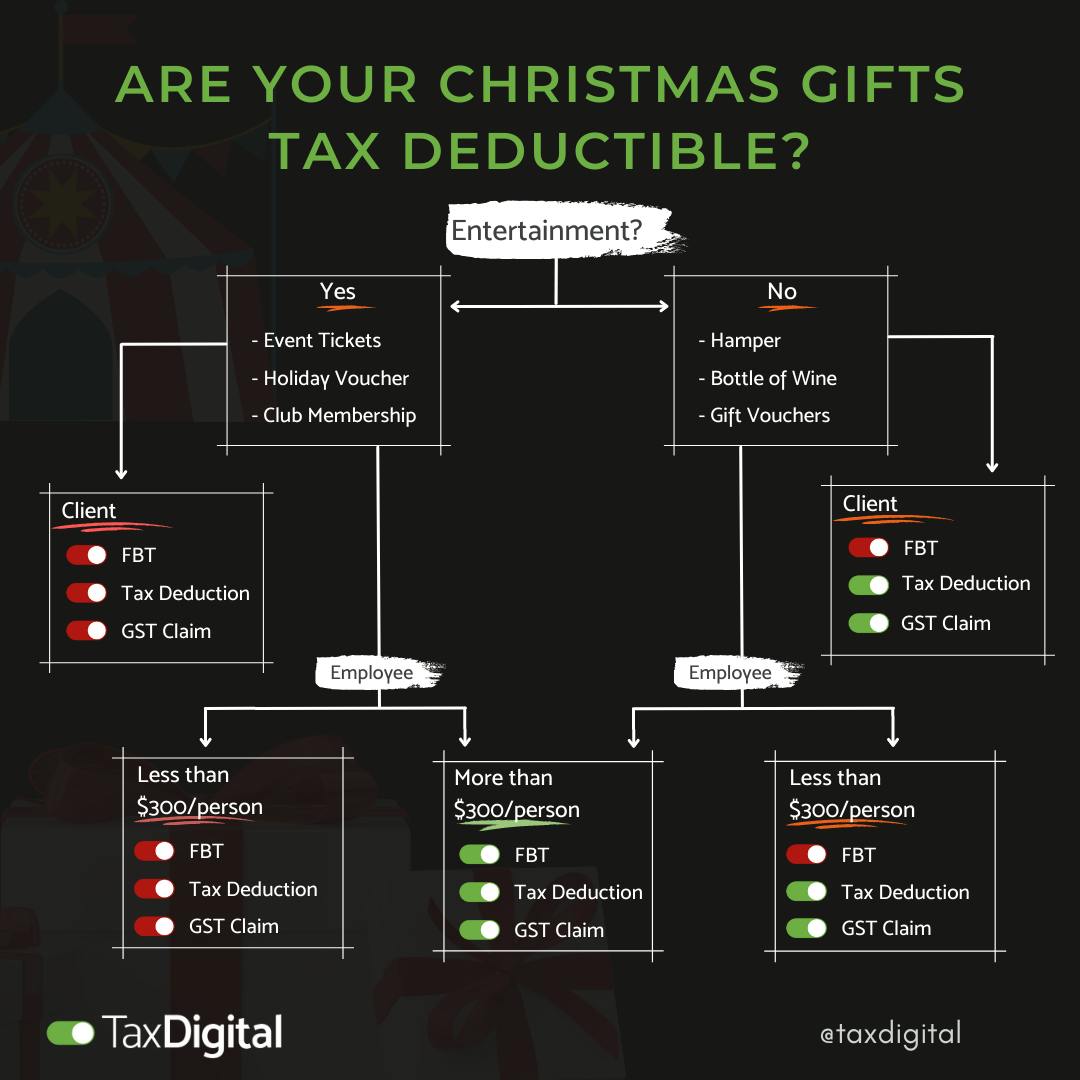

A gift could actually be a 'gift', or it could be classified as 'entertainment'. A 'gift' includes traditional items such as hampers, boxes of chocolates, bottles of wine, etc. Whereas 'entertainment' includes things like movie tickets, holiday home vouchers, etc.

Gifts that are 'Gifts"

Employee 'gifts' are tax-deductible and are subject to Fringe Benefits Tax (FBT) if the cost of the item is more than $300. The minor benefits exemption will apply if it is under $300, and no tax deduction is allowed.

Client gifts are tax-deductible regardless of the spend. FBT does not apply either.

Some deductible gift idea's include:

- Gift vouchers (groceries, books, etc.)

- Wine

- Flowers

- Chocolates

- Perfumes

- Indoor plants

Gifts that are 'Entertainment'

Employee 'entertainment' gifts are tax-deductible and are subject to FBT if the cost of the item is more than $300. The minor benefits exemption will apply if it is under $300, and no tax deduction is allowed.

Client 'entertainment' gifts are not tax-deductible regardless of the spend. FBT does not apply either.

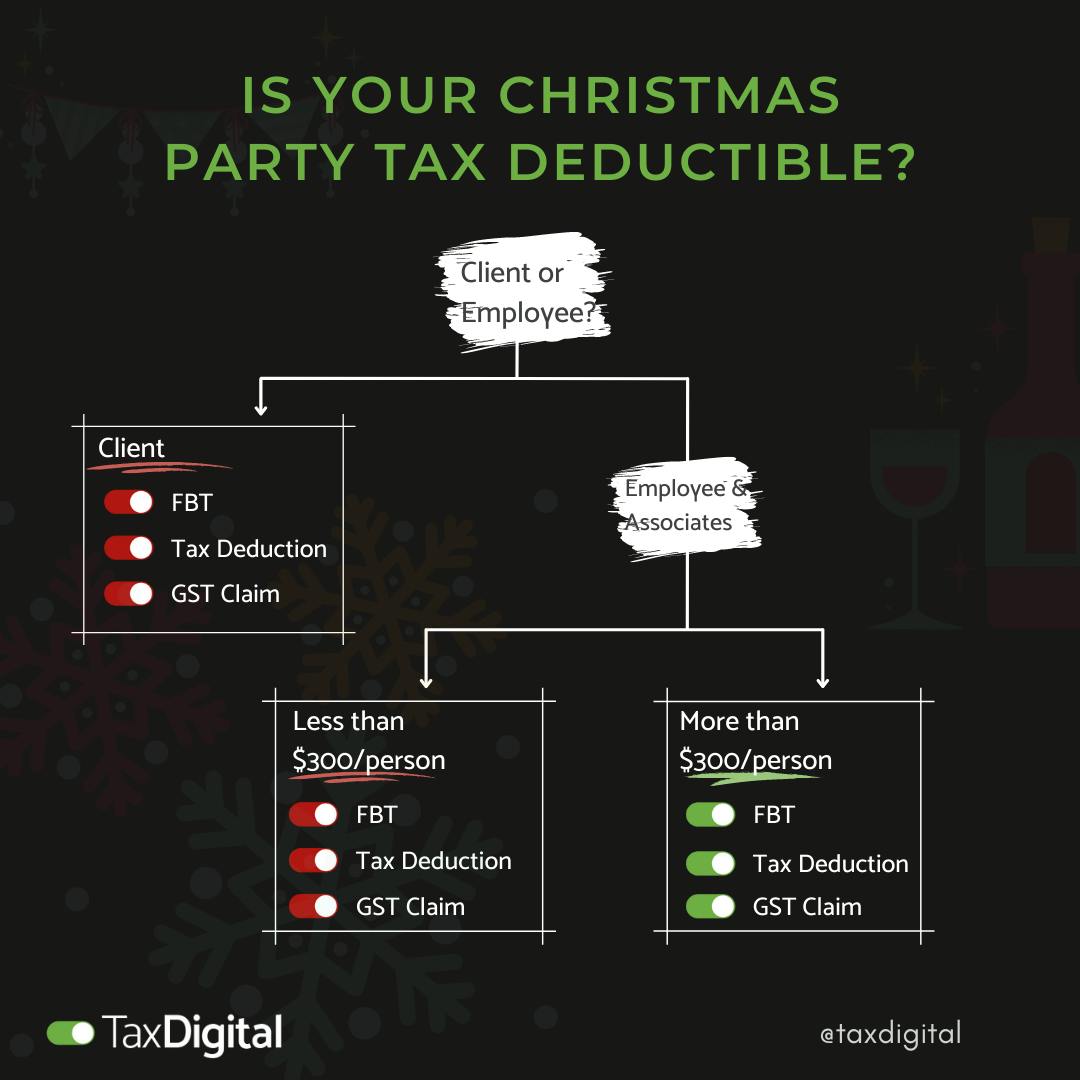

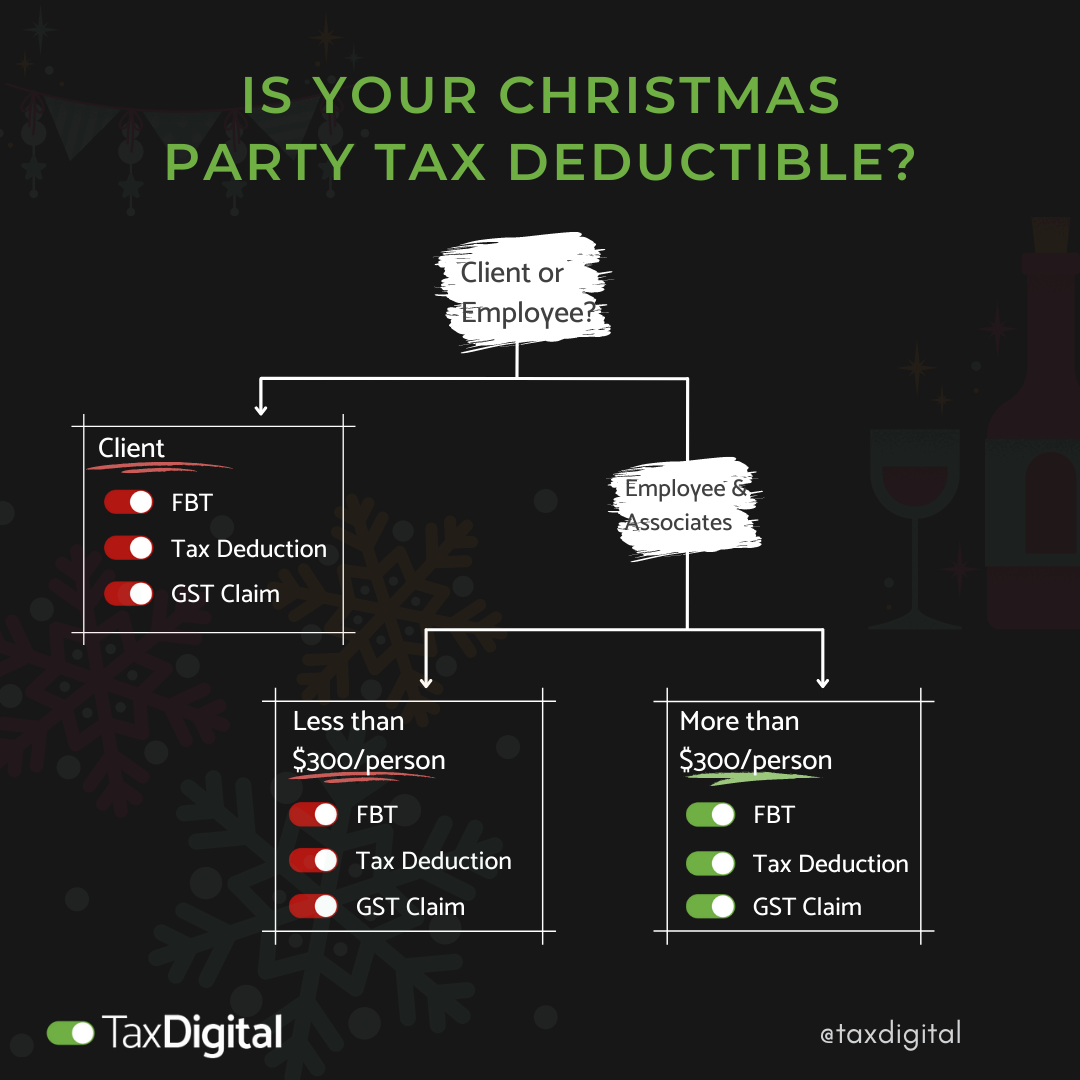

Christmas Parties

Generally speaking, Christmas parties will be exempt from FBT if they are held on a regular business day, on the work premises, only employees attend, no alcohol and only light meals are provided......who calls that a Christmas party? I don't know.

Where you hold a Christmas party offsite and the cost per employee/associate is less than $300 (inc. GST), then the minor benefits exemption will apply, and no tax deduction is allowed.

Where you hold a Christmas party offsite and the cost per employee is more than $300 (inc. GST), then the cost is tax-deductible and is subject to FBT.

Where a Christmas party is held for clients, then the cost is not tax-deductible regardless of the spend. FBT will also not apply.

Where a mix of both employees and clients attend a Christmas party, then you need to keep specific records of attendees and the cost per head to correctly calculate your tax deductions and FBT liability.

Need Assitance?

Clear as Mud? (Yes, I had a giggle when I reread this article.) It's an absolute nightmare; we know it. At TaxDigital, we specialise in making sure you are compliant and aren't exposed to thousands of dollars in tax. Feel free to reach out to us on 0407 438 849 or contact@taxdigital.com.au if you would like some personalised guidance on the tax consequences of your Christmas Party/Gifts.

This is general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your circumstances or seek personalised tax advice from us at TaxDigital. Information is current at the date of issue and may change.

Recent

Get the latest industry and tax information from our small business blog.